Important Things to Know When You’re in a Reverse Mortgage

1. Notify the Lender If You’ll Be Away From Home for Extended Periods

Your home tells the story of your life. It’s where birthdays were celebrated, family dinners were shared, and milestones were made. Now, as you look toward retirement, your story is still unfolding — and financial peace of mind is a big part of it.

Why it’s critical: Your home must remain your primary residence under the terms of a reverse mortgage.

If you are away for more than 6 consecutive months (for medical reasons) or more than 12 months (for non-medical reasons), your loan could be considered in default.

Always let your lender know if you expect to be gone for an extended time.

2. Complete and Return the Annual Occupancy Certification

Why it’s critical: Each year, your lender will send a simple form asking you to confirm that you still live in your home as your primary residence.

Failing to return this form can trigger serious consequences, including possible foreclosure.

Take a few minutes to complete and return it promptly — it protects your right to stay in your home.

3. Always Pay Property Taxes, Insurance, and Do Repairs

Why it’s critical: While you no longer make monthly mortgage payments, you are still responsible for:

Property taxes

Homeowners insurance

Basic home maintenance and repairs

Not keeping up with these obligations can place your reverse mortgage in default and lead to foreclosure.

Our Commitment to You

At My Reverse Options, we want every client to feel confident, secure, and supported in their reverse mortgage journey. That’s why we’re here to answer questions, provide reminders, and help you navigate these requirements with ease.

📞 If you have any concerns about your reverse mortgage obligations, call us at (877) 611-6226. We’re here to guide you every step of the way.

Licensing

Contact Us

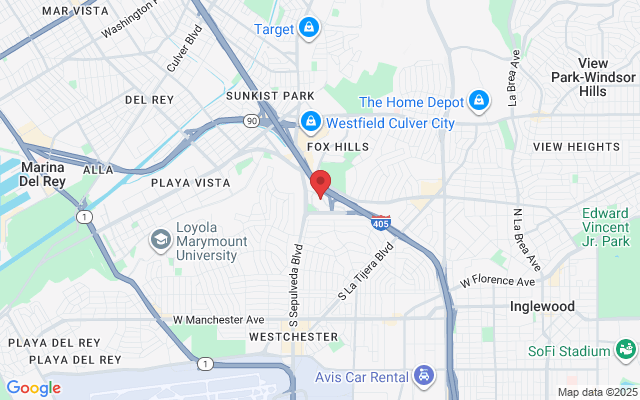

6080 Center Drive

6th Floor

Los Angeles, CA 90045

More Links

Disclaimer: My Reverse Options, Inc. is a licensed CA Mortgage Broker, NMLS #1928866. All loans are subject to approval and processed under our license. We are not affiliated with HUD or the FHA. Information on this site is for general purposes only and not financial, legal, or tax advice. Partner lenders may include Finance of America, Longbridge Financial, and Mutual of Omaha.

© 2025 My Reverse Options, Inc. All rights reserved.